Rachel Infante is a CERTIFIED FINANCIAL PLANNER® professional and member of the Financial Planning Association. Serving clients at Birchwood Financial Partners, Inc. in Bloomington, MN and the surrounding communities.

Rachel credits her past experiences, some challenging, for her ability to connect and build relationships with clients. Rachel’s greatest joy is coaching people through times of transition and change, and helping people work through their choices to make decisions that match their goals.

Rachel has a passion for helping those going through, or who have experienced a divorce. As one who has been through a divorce herself, with young children, she sympathizes with the shock and complexity this can bring. As a Certified Divorce Financial Analyst® professional, she helps those better understand the financial aspects of the divorce process and the unique financial planning that follows.

Rachel volunteered for many years with the Financial Planning Association, planning and coordinating an annual conference that brings lots of education to financial advisors each year. She is also involved with Best Prep as an e-mentor helping high school students learn more about financial planning and the importance of this throughout their lives.

Rachel is originally a native of Texas but has called Minnesota home for many years. Rachel currently lives in Chaska with her twins Amelia and Austin. She loves to travel, camp, hike and spend time outdoors as much as the Minnesota weather allows.

Rachel began college pursuing a degree in Finance with aspirations of becoming a financial analyst in the corporate world. After just one course in personal finance that all changed. She knew her passion for helping people and Financial Planning were a perfect fit.

Prior to joining Birchwood, Rachel worked for a family owned financial planning firm for over ten years, including roles such as Financial Advisor and more recently Chief Compliance Officer.

When planning for retirement, most people focus on saving, and rightly so. Having enough money to fund your retirement dreams is a key element...

Read More >

Football. Fall foliage. Falling temperatures. Autumn has arrived, and with it is a golden opportunity for members of the American workforce to...

Read More >

A recent study done by Financial Finesse reveals that women lag men in many vital areas of financial planning, most notably falling behind when...

Read More >

With the pressures we face on the job, very few of us think about reviewing every benefit we get from our employers – unless something goes...

Read More >

After putting down roots during their working years, it’s no surprise that most people choose to stay put when they retire. According to a...

Read More >

A 529 plan is a savings plan that allows individuals to save for a beneficiary’s college expenses. Invested funds grow tax free and, provided...

Read More >

Now that you have diligently and thoroughly thought out your estate plans and have visited your attorney to legally document those estate plans...

Read More >

Why can it be so difficult to save for the future? Do you know precisely how much money you should be saving today? Are you saving enough? If...

Read More >

Financial aid is a broad term that covers financial help through the college your child attends. Financial aid includes merit and needs-based...

Read More >

Whether you or a loved one are going for a scheduled hospital stay, don't stop with your doctor's orders – get your financial orders in place,...

Read More >

Thank you for your submission

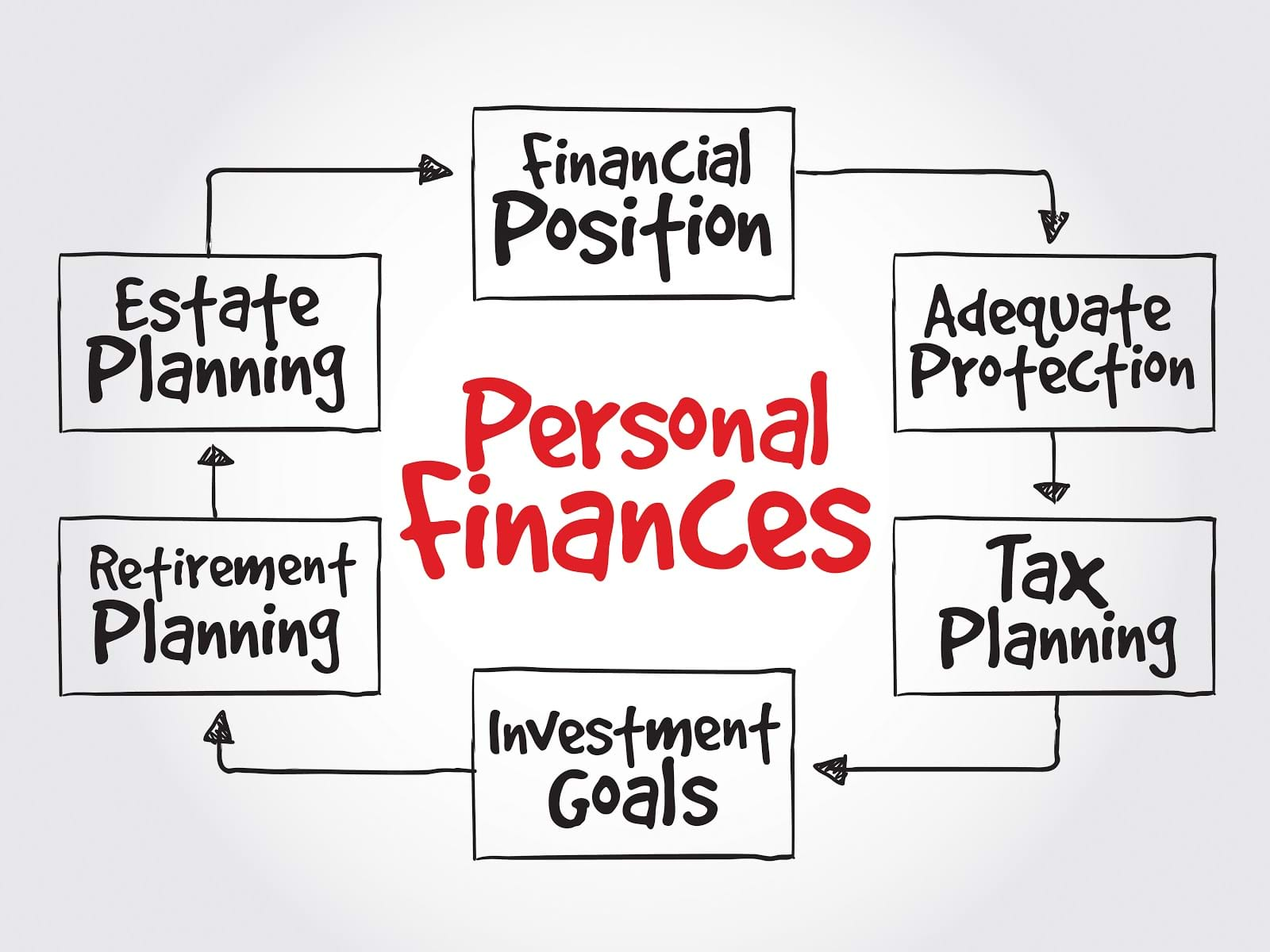

Planner Search is a financial planning resource for individuals, families, and businesses. Find a caring and credentialed financial advisor serving the Bloomington, MN area. Financial planners offer a wide range of services including: tax planning, retirement planning, estate planning, insurance planning, inherited ira, and more.

The Planner Search directory is made Financial Planning Association (FPA) members and includes CFP® professionals, educators, financial services providers, and others who follow the highest standards of professional competence and integrity. Contact a financial planner today and find out how they can help you prepare financially for major life changes, investments, personal finance, or business finances.